13th Annual | One-Day, Industry-Led Conference & Networking Exhibition, 10 Union Street, London | 21st May 2026

Satisfaction Rate At Our Last Event

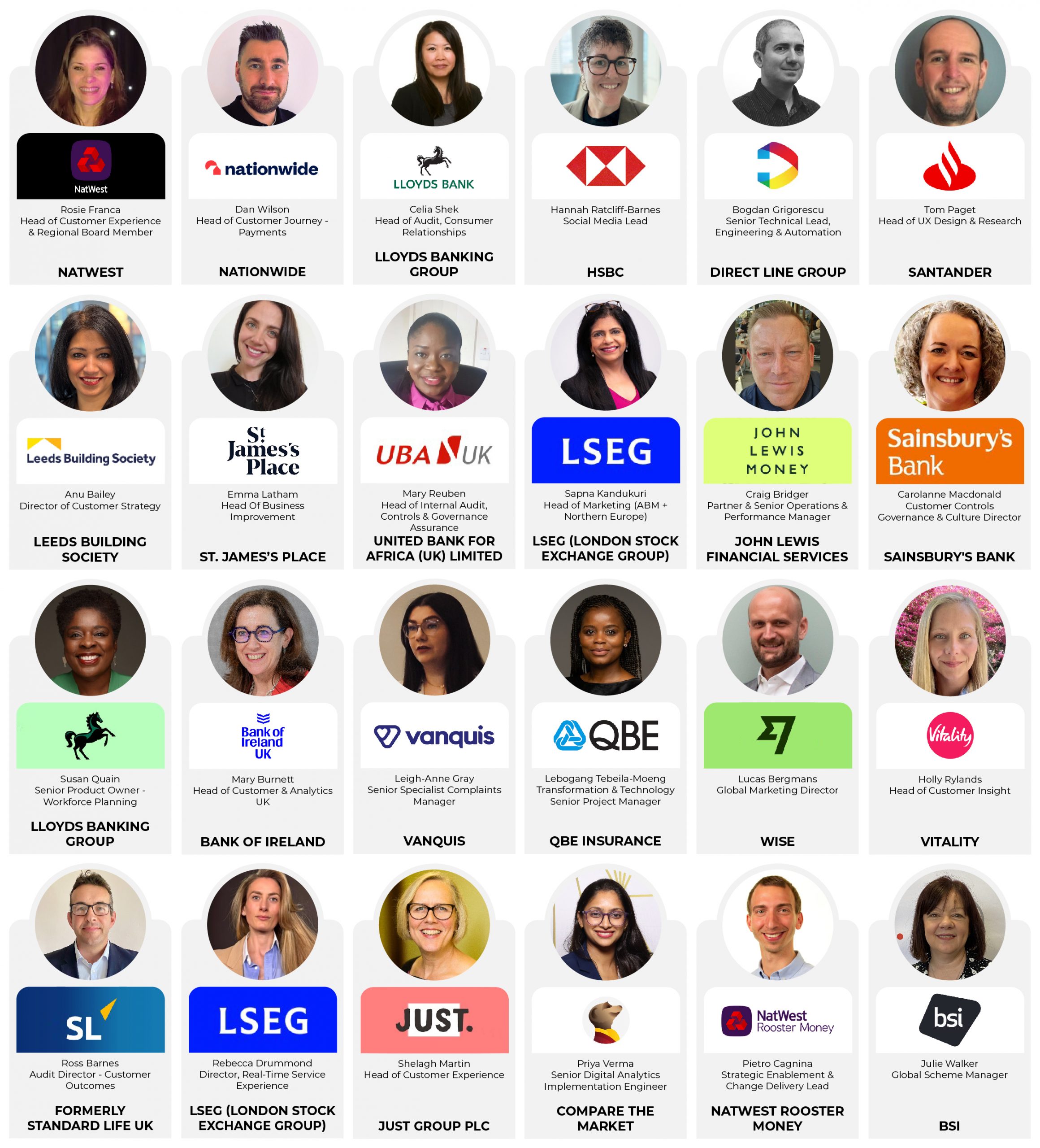

Finance Brand Speakers

Panel Discussions

Unmissable, Inspiring Day!

23 Finance Industry-Leading Experts In Customer Experience, Journeys, Engagement & UX Unite To Deep-Dive Into The Latest Human-Driven, Tech-Enhanced CX Strategies That Put The Customer Front & Centre – All In Just 1 Jam-Packed Day In Central London

Send your team: For more information, please call +44 (0) 203 479 2299 or email info@financialservicesconference.com

The 13th Annual Edition Of The Industry-Leading CX Conference For Financial Services Professionals.

Key AI & Automation Innovations ■ The Essential Human Touch ■ Streamline Your Customer Journey Roadmaps ■ Key Support For Vulnerable Customers ■ Building Customer-Centric Company Cultures ■ ROI Measurements & Metrics ■ Latest Insights In Customer Expectations ■ Harnessing Data For CX Strategies

1

Leverage AI & Automation Technology:

Deploy the latest AI tech to deliver high-impact customer results with reduced time and spend

2

Human In The Loop:

Maintain human interaction and soft skills as a key driver in your CX strategies

3

Map Your Optimal Customer Journey:

Reduce friction points and join the dots across channels for a seamless consumer experience

4

Offer Critical Support To Vulnerable Customers:

Use empathy and understanding to power key outcomes where they matter most

5

The Latest Digital Innovations:

Future-proof your business practices with cutting-edge tech developments

6

A Customer-First Mindset:

Unify all aspects of the business and workforce around a customer-centric approach at all levels

7

Measuring & Showcasing ROI:

Leverage the latest metrics and measurement techniques to craft a narrative that shows your CX success

8

Regulations & Compliance:

Prioritise customer safety, data privacy and cybersecurity with fully compliant business practices

9

The Voice Of The Customer!

Harness customer feedback and shifting behavioural patterns to assess customers’ crucial priorities for 2026 and beyond

10

Better Data For Better Outcomes:

Embed relevant and accurate data into your CX frameworks for timely and effective outcomes

11

Eye-Catching Hyper-Personalisation:

Stand out from the crowd with tailored content that speaks to each customer’s critical needs

12

What’s Next For CX?

Scan the horizon to forecast the next stage of evolution for financial services customer experience

Brand New For 2026…

- Cutting-Edge Insights From Leading FS Brands including NatWest, Lloyds Banking Group, HSBC, Aviva, Direct Line and many more

- Senior Speaker Line-Up Including 11 Heads & 6 Directors

- Hottest Topics Covered Including AI, Vulnerable Customers, Striking The Right Human/Digital Balance And Customer Journey Management

- Live AI Demonstrations: New Format Innovation!

- 4 Interactive Panels – Be A Part Of The Conversation & Put Your Burning Questions To Our Expert Panels

– Streamlined & Optimised Customer Journeys Panel, Featuring Aviva, Bank Of Ireland, Standard Life UK And More

– Critical Customer-Centric Company Cultures Panel, Featuring Lloyds Banking Group, HSBC, NatWest Rooster Money And More

– Key Insights In Evolving Customer Behaviours & Expectations Panel, Featuring Lloyds Banking Group, NatWest, Wise And More

– 2027 & Beyond! The Future Of CX Strategies Panel, Featuring JPMorgan, Direct Line Group And More - 2+ Hours Of Dedicated Networking Time

- Interactive Hot Topic Informal Discussions

10 Reasons To Convince Your Boss On Why You & Your Team Should Attend This Long-Standing & Industry-Leading Financial Services Customer Experience Event:

- Big name financial services brands speaking including NatWest, Lloyds Banking Group, HSBC, Aviva, Direct Line and many more

- Innovative insights and fresh perspectives from FinTechs

- Senior speaker line-up, featuring 11 heads and 6 directors

- Unmissable agenda featuring only the hottest topics, drawn up from extensive industry research and peer interviews

- Key focus on essential topics, including AI and supporting vulnerable customers

- Four panel discussions with Q&A, your chance to put the burning questions straight to the experts

- Breakout sessions to deep-dive into key topics with like-minded peers

- Over two hours of networking time to expand your network and forge key industry connections

- Practical tips and actionable strategies to take back to the office and unlock critical career advancement

- All in a central London location, in just one day out of the office!

Who Attends The Financial Services Customer Experience Conference?

Don't Just Take Our Word For It.....

Send 4 delegates for the price of 3 OR send 3 and get your third place half price!*

* This applies to inhouse practitioners only, not agencies and suppliers, and cannot be used in conjunction with any other discounts, including earlybird offers.

Partner With Us – Speak, Sponsor, Exhibit Or Connect Through

One-to-One Meetings At The

Financial Services Customer Experience Conference

Can You Help Financial Services Customer-Focused Professionals Improve Key CX Strategies?

Book An Exhibition Stand + 2 Delegate Passes:

Book Today For Just: £4,999 + VAT

For more information on how to get involved, please call +44 (0)20 3479 2299 or email

partner@financialservicesconference.com

Please remember to check your junk folder for the brochure – and add @gicconferences.com to your safe senders list.

Take A Look At Our Sister Events

Global Insight Conferences is a rapidly-expanding and highly entrepreneurial conference company. We only employ individuals who are passionate about conferences, passionate about their personal growth and performance and passionate about being the best.

Please send your CV with a covering letter to hr@globalinsightconferences.com